Introduction

When it comes to controlling debt and making big purchases without fear of interest piling up, 24 months interest-free credit cards have become the financial world’s best-kept secret. But here’s the twist—some cards go above and beyond by turning zero-interest into a strategic superpower.

In 2025, a select group of six credit cards are changing the game entirely. They’re not just delaying interest—they’re reshaping how smart spenders manage money, handle debt, and make strategic investments in their future. These cards come packed with unique features, longer promo periods, and real user benefits that go far beyond typical offers.

Let’s dive in and uncover why these 6 standout cards are rewriting the rules of personal finance.

WE ARE STILL MAKING CVs FOR P120. COVER LETTERS FOR P60

Pay with FNB EWallet to 76981238 or Orange Money on number 76981238

Whatsapp us on +26776981238

JOIN US ON OUR WHATSAPP CHANNEL HERE

Why 24 Months Interest-Free Credit Cards Are a Game-Changer

A Revolution in Consumer Finance

Zero percent APR offers used to be rare perks. Now, they’ve become strategic tools that everyday consumers can wield to control interest, reduce stress, and regain financial power.

The magic is in the math: with average credit card APRs topping 20%, going 24 months without paying interest can mean saving thousands—whether you’re spreading the cost of a wedding, home upgrade, or consolidating medical bills.

In essence, you’re borrowing someone else’s money for two years for free, and that’s not just helpful—it’s revolutionary.

The Psychology of Zero Interest

It’s not just the savings that matter. There’s a powerful psychological impact to having zero-interest breathing room:

-

Stress Reduction: Knowing interest won’t snowball gives you peace of mind.

-

Financial Clarity: You can focus on principal repayment without distractions.

-

Empowerment: You control the timeline—something traditional cards rarely offer.

But remember, it’s still debt. The emotional ease should fuel smart repayment, not reckless spending. That’s the key difference between a game-changer and a trap.

The Six Cards That Are Reshaping the Credit Landscape

Exclusive Features That Set Them Apart

These six 24 months interest-free credit cards aren’t just average offerings—they’re innovation in plastic form. Each brings unique tools to the table, offering much more than just a long promo period. Let’s explore what sets them apart:

-

ClearTrust Platinum+

-

0% APR on both purchases and balance transfers for 24 months.

-

No annual fee, and a flat 2% cashback on all purchases.

-

Comes with fraud monitoring and purchase protection.

-

-

FlexiLine Rewards Visa

-

24-month 0% APR only on balance transfers.

-

5% rotating category cashback.

-

Transfer fee capped at $100 regardless of amount.

-

-

Nova Prime Credit

-

24 months no interest on purchases only.

-

Offers 3x points on travel and dining.

-

Includes rental car insurance and no foreign transaction fees.

-

-

SmartPay Pro

-

Dual 0% APR offer: 18 months on purchases, 24 months on transfers.

-

1.5% cashback plus access to a credit-building dashboard.

-

Ideal for users working to improve credit while saving on interest.

-

-

EliteCurve Cash Card

-

Full 24-month 0% intro on everything, plus a one-time $200 welcome bonus.

-

No annual fee and unlimited 1.75% cashback.

-

Includes zero-liability fraud protection and mobile wallet compatibility.

-

-

TrustBank Momentum

-

0% for 24 months only on large purchases ($500+).

-

Comes with extended warranty, travel perks, and roadside assistance.

-

No balance transfer options, but loaded with purchase perks.

-

Each of these cards is designed with a specific type of consumer in mind. Whether you’re looking to slash interest, earn rewards, or travel smart—there’s a fit here for you.

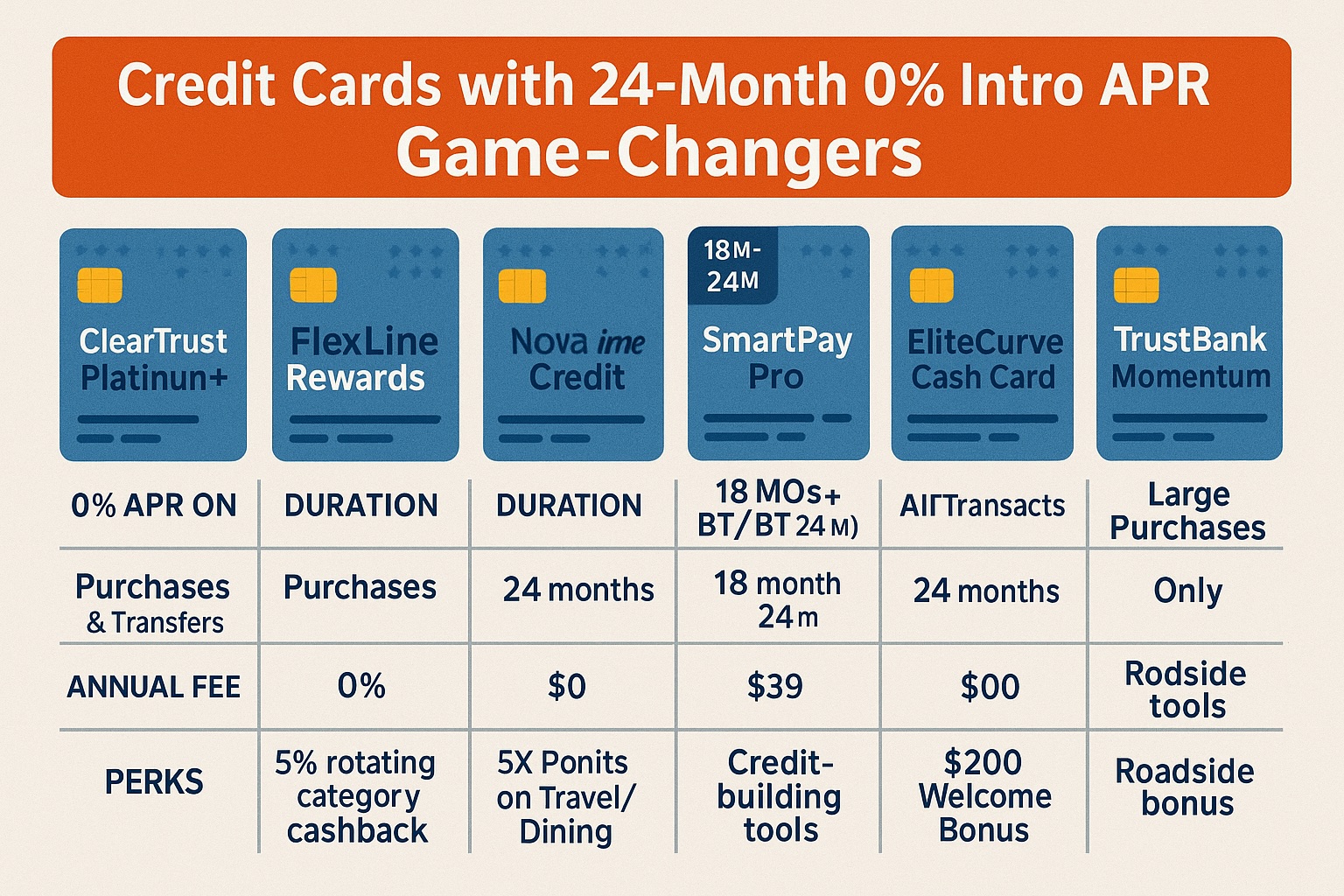

Quick Comparison Snapshot

|

Card Name |

0% APR On |

Duration |

Annual Fee |

Perks |

|---|---|---|---|---|

|

ClearTrust Platinum+ |

Purchases & Transfers |

24 months |

$0 |

2% Cashback |

|

FlexiLine Rewards Visa |

Balance Transfers Only |

24 months |

$0 |

5% Cashback |

|

Nova Prime Credit |

Purchases Only |

24 months |

$39 |

3x Travel/Dining |

|

SmartPay Pro |

Purchases (18m) & BT (24m) |

Mixed |

$0 |

Credit Tools |

|

EliteCurve Cash Card |

All Transactions |

24 months |

$0 |

Welcome Bonus |

|

TrustBank Momentum |

Large Purchases Only |

24 months |

$59 |

Roadside/Travel |

What You Can Do with 24 Interest-Free Months

Smart Budgeting for Life’s Milestones

Two years of no interest is more than just a financial break—it’s a powerful planning tool. With a solid budget and a 24-month window, you can strategically handle major life events without high-interest debt weighing you down. Here are a few smart uses:

-

Weddings & Events: Plan your big day stress-free, paying off expenses over time without the extra cost.

-

Home Upgrades: Finance a kitchen remodel or new furniture while maintaining cash flow.

-

Education & Career Development: Use the time to pay for courses or certifications, boosting your income potential without incurring interest.

This isn’t just about deferring payments—it’s about leveraging time to align your income with your goals, strategically.

Set a target payoff amount each month. If you charge $4,800, commit to paying $200 a month. Add auto-pay and set calendar reminders to stay on course. It’s methodical, and it works.

Debt Freedom Through Strategy

For many, 24-month 0% cards are the ultimate tool to escape the interest trap. Here’s how:

-

Debt Consolidation: Transfer balances from cards with 25–30% APR and put your repayment into high gear.

-

Snowballing Made Easy: Focus payments on one large balance while paying minimums elsewhere—interest-free.

-

Emergency Cushion: If used wisely, these cards provide flexibility during income dips or emergencies, without resorting to payday loans or high-interest lines.

Remember: the freedom is temporary. What you do during these 24 months determines whether you emerge debt-free or deeper in the hole.

The goal? Treat the card like a zero-interest personal loan, not a spending spree. If you maintain focus, you can rewrite your financial future one payment at a time.

The Hidden Fine Print: What to Watch For

Balance Transfer Clauses Explained

The appeal of 24 months interest-free credit cards often lies in their balance transfer offers—but these come with conditions that can catch you off guard if you’re not careful:

-

Transfer Window Limits: Many cards only allow 60–90 days after opening for you to transfer balances. Miss this window and the 0% offer may no longer apply.

-

Transfer Fees: While you’re avoiding interest, you might still pay a fee—usually 3% to 5% of the balance transferred. Transferring $5,000 could cost up to $250 upfront.

-

Order of Payments: Issuers may apply payments to the lowest-interest balance first. So if you make new purchases, you may end up paying those off before your transferred balance.

-

Intro APR Loss: Missed payments can void your promo rate. Just one mistake could trigger the standard APR on your entire balance.

These are not just fine print—they’re landmines for the unprepared. Know the rules before you play the game.

Intro vs Ongoing APR Realities

While 0% APR sounds great, it’s temporary. Here’s what happens after the honeymoon:

-

Standard APR Activation: After 24 months, your card switches to a “go-to” APR—often in the range of 18% to 27%. Any remaining balance will immediately begin accruing interest.

-

No Grace Periods: Some cards stop offering a grace period if you’re still carrying a balance once the intro period ends, meaning new purchases might incur interest right away.

-

APR on Missed Payments: The penalty APR (often over 29%) can be triggered by a late or missed payment. It’s a harsh reset button for anyone not paying attention.

Understanding these details can make the difference between a savvy financial move and an expensive mistake. So read the full cardholder agreement—even the boring parts.

How to Apply and Actually Get Approved

Boosting Approval Chances with Smart Moves

Getting one of these 24 months interest-free credit cards isn’t just about hitting “apply”—it’s about applying smartly. Issuers want to see that you’re low-risk and reliable. Here’s how to tilt the odds in your favor:

-

Know Your Score: Most of these premium cards require a credit score of at least 690. Use free tools to check before applying.

-

Pay Down Existing Balances: Lowering your credit utilization ratio can give your score a quick boost.

-

Avoid Recent Applications: Multiple credit inquiries within a short time can reduce your approval chances.

-

Check for Pre-Qualification: Many banks offer pre-approval with no impact to your credit—use it to see where you stand.

-

Update Income Accurately: Include all sources of income—salary, freelance work, investments—to show stronger repayment capability.

Being prepared doesn’t guarantee approval, but it seriously improves your odds—especially when you target cards that fit your credit profile.

Common Mistakes to Avoid

Even financially savvy applicants can make simple errors that sabotage their approval chances. Watch out for these missteps:

-

Applying for the Wrong Card Type: Don’t apply for a balance transfer card if your goal is new purchases—and vice versa.

-

Overlooking the Fine Print: Be sure you understand the duration, fees, and what triggers a penalty APR.

-

Rushing the Application: Double-check every field—mistakes in income, address, or SSN can cause automatic rejections.

-

Ignoring the Impact of Hard Inquiries: Every application can ding your credit by a few points. Space out your applications.

Lastly, never apply impulsively. Take time to compare options, prepare your credit file, and apply strategically. It’s a little effort for a lot of reward—potentially two years’ worth.

Conclusion

When used wisely, 24 months interest-free credit cards are far more than a marketing gimmick—they’re transformative tools for financial empowerment. The six standout cards we’ve explored offer consumers the ability to take control of their money, whether it’s escaping the chokehold of high-interest debt or financing big life events on your own timeline.

These cards aren’t for everyone. They require discipline, planning, and awareness of the fine print. But for those ready to use them strategically, the benefits are huge: two years of breathing room, freedom from interest, and a path to better credit health.

If you’re thinking about making a financial move this year, don’t overlook the power that lies in 24 months of zero interest. Choose the right card for your lifestyle, map out your repayment strategy, and you could walk away not just debt-free—but smarter, stronger, and more in control than ever.